Its time to start culling woodland,scavenging fuel from dumpsters and wearing warmer clothes

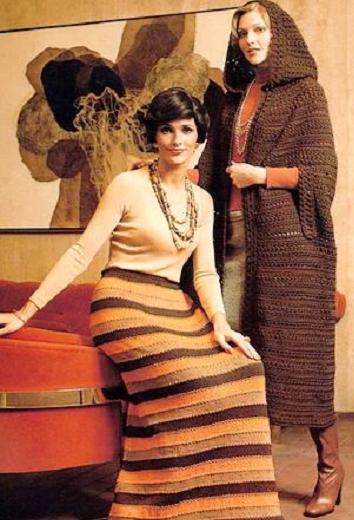

Start foraging in Granny’s closet — if forecasts by Deutsche Bank are true, we are heading for =higher energy prices very soon. The bank’s researcher estimates that prices will rise a further 25% by 2015, meaning that the average household will be spending more than 4% of their disposable income on fuel bills, back to the levels seen following the oil shocks of the1970s. For households, Deutsch Bank surmise that the only way that energy prices would be lower than forecast is if there were a recession — but the lower energy prices would be of little comfort to those out of work. Perhaps those furry waistcoats and long cardigans so beloved of the 1970s may be the trick to staying warm in winter. Driving the increase is not just the growing demand for fuel but the growing dependency on imports. In the UK, the boon from North Sea oil and gas fades. The UK stopped being a net exporter of energy after 2003 and since then it has been increasingly at the mercy of international fuel prices. For the sellers of household energy, those utilities with upstream (producing assets) should be better placed than those that have to buy more of their energy in from wholesale markets.Centrica, with its storage, generation and upstream gas and oil, and SSE with its considerable wind and hydro production as well as fossil fuel production have the potential to benefit from upstream earnings cushioning any squeeze in profit margins in retail (downstream supply).