Kenyan company Sun King calls itself “the world’s largest off-grid solar energy company.” That’s not just marketing hyperbole—and it’s a statement that reveals how the energy landscape has shifted beneath our feet. The company’s recent $156 million securitisation (meaning sale of their existing revenue streams), the largest of its kind in Africa, isn’t just another funding round. It’s a watershed moment that signals the off-grid solar industry has finally matured from a niche development sector into a legitimate financial asset class that commercial banks are willing to bet serious money on.

But here’s what makes this story truly compelling: Sun King’s claim to being the world’s largest isn’t based on the usual Silicon Valley metrics of valuation or venture capital raised. Instead, it’s built on something more meaningful—actual impact at scale. With over 27 million solar products sold, 23 million homes powered, and $1.3 billion in solar loans extended to nearly 10 million customers across 46 countries, Sun King has quietly assembled the largest customer base in the off-grid energy sector while most of us were still debating whether distributed solar could ever be commercially viable.

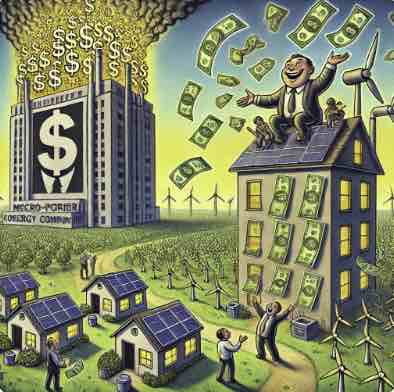

For the first time, commercial banks are treating off-grid solar as a mainstream financial asset rather than a development experiment. This legitimisation opens doors to capital pools that dwarf traditional development finance, creating the potential for unprecedented scale in clean energy deployment.

The timing of this funding is significant. As the world grapples with energy security, climate change, and the persistent challenge of providing electricity to 1.8 billion people who still lack reliable access, Sun King’s securitisation proves that market-based solutions can scale to meet these challenges—if we’re willing to think differently about how energy systems work.

Off-grid solar companies lacks the standardised metrics that financial analysts need to define leadership in traditional energy markets. Unlike utility-scale solar where gigawatts of installed capacity provide clear rankings, or residential solar where revenue figures tell the story, off-grid solar operates in a more complex ecosystem where success must be measured across multiple dimensions.

Sun King’s claim to the crown rests on several metrics. First, customer reach: with nearly 10 million individual customers served, Sun King has built a customer base that dwarfs its closest competitors [1]. For context, d.light, another major player founded the same year as Sun King’s predecessor Greenlight Planet, reports revenue of approximately $217-309 million annually but serves significantly fewer customers [2]. M-KOPA, the Kenyan fintech-solar hybrid, boasts higher reported revenue at $618.8 million but operates primarily in East Africa with a more limited geographic footprint [3].

What’s particularly striking is Sun King’s product volume: over 27 million solar products sold represents a scale of manufacturing and distribution that few companies in any sector achieve, let alone in the challenging off-grid markets of Africa and Asia. This isn’t just about bragging rights—it demonstrates something crucial about the company’s operational capabilities and market penetration …

A reckoning is due for Great British Energy – the UK government’s nascent £8.3b industry accelerator. Announced as the centrepiece of the UK “growth mission” its launch was accompanied by the news that it had spent £640m buying the nerve centre of the National Grid – the control room that apportions energy across the country on a live daily basis. In 2035 we may look back on that deal and think “only £640m…” British energy Minister Ed Miliband has firm plans to waste billions by then – on carbon capture and Contracts for Difference, as well as reparations to low-lying islands in the Pacific, and thousands of hotel nights spent attending Cops30-40.

Literally anything could happen to the UK energy supply this winter, and almost all of it is bad.

But there is also something we can all do in our individual communities – to prepare for possible power cuts, this winter or any other winter.

After all, every household in the UK spends an average of £1700 a year on energy.

Ed’s big problem is that he has raised expectations. He announced that not only will he solve the nation’s energy conundrum, but that he will also save money while doing it, keep the lights on, build 1.5m new home and launch a new global Britain on the back of it.

The energy industry, and the entire country, is waiting for action. But Britain can never be an energy super-power, and Ed must know this.

Consider the facts – Annual GB electricity consumption is 292.7 terawatt-hours (TWh) of electricity in 2023, about the same as Texas, a vast state with multiple connectivity issues in outlying areas. The UK has a small, compact grid, which is currently undergoing major re-engineering for decarbonisation.

Electricity demand is forecast to grow at 5% a year, but generation is not increasing at the same pace until 2029. The maximum power to be provided by two new nuclear plants planned (if they are on time it would be a first) is 56TWh. And Ed wants sharp reductions in oil and gas for electricity production. That produces a shortfall of another 50TWh by 2029

Then there is a 10-yr waiting list for new housing estates to get on the grid. That’s right – ten years from time of application to secure a supply from the grid. Yet Labour says it will build at least a million homes in the next 4 years. How will it power the new homes? There is also a 10-yr waiting list for new solar farms to go on the grid, due to structural problems that require hundreds of miles of new cabling and pylons. Quite simply, the grid is not fit for purpose, and nor is there the slightest chance it will be re-engineered until well after 2030. Nevertheless, the government says it wants to decarbonise the electricity system by 2030.…

The UK Government last week laid out the domestic plan for its first year in office -prioritise housing and clean energy, in order to kickstart growth.

The duo in charge of these policies – Angela Rayner (housing) and Ed Milliband (energy), did not co-ordinate their announcements last week, and there is a feeling in energy circles that both policies may fall flat for the same reason – delays in generating clean energy to the places where housing is most needed.

Housing and energy are closely connected – you cannot build new communities until the power supply is in place. We know that there is currently a 10 year wait to connect new housing estates to the grid in some parts of the country, and a 10 year wait to connect a solar farm to the grid in others.

The government also launched its vehicle for its energy initiatives last week, Great British Energy, to be run by former Siemens executive Juergen Meier. it is going into the business of picking winners – but energy for housing does not appear to be in the list. £8.5b has been announced for it to co-invest with big industry players in the next generation of wind and solar farms. But these projects take years to start generating power. It took the best part of a decade to build the Hornsea 1 Windfarm, and that was AFTER planning permission was granted in 2014. So reforms to planning permission on which the government is currently consulting are unlikely to make much impact.

And the recent history of government energy deals shows the Civil servants charged with negotiations were ham-fisted and outmanoeuvred at every turn. The UK chair of French energy company EDF, Alex Chisholm, previously ran BEIS, the department that struck the deal for EDF to build a new nuclear power station in Somerset., as reported in the Guardian. “The agreement was made in 2016 with UK bill payers bearing the costs, which soared from an estimated £18bn to at least £31bn…. it is due to be completed in 2031 – about 14 years after EDF said it would be up and running.” In 2023, EDF was the leading company in the wholesale electricity generation market in Great Britain, with a share of 18.5 percent. The UK branch of the German company RWE ranked second last year, with a market share of approximately 17.5 percent

Data centres and EVs will gobble up all the new energy the grid can produce in this country for the next ten years.

Where does that leave the new housing starts that are so badly needed? How will they get their energy this year?

The big energy consumers will always need the grid, but for at least some new housing estates, electricity could be supplied from small local microgrids that do not need to be hooked up to the main grid …

Plans have been lodged that could see properties in one of Northumberland’s most rural areas connected to the electricity grid for the first time. There are believed to be around 350 families across Northumberland living off-grid, with no utility bills, and able to enjoy the night sky with no light pollution.

Lobbyists from the power company say children are bathing in streams and doing homework using headtorches, while people struggle with basic household tasks. The local council and the local Utility company are conducting a PR blitz to persuade residents to go along with the scheme. Families are being quoted thousands of pounds by power companies to be connected to the grid. Write to us if you oppose the scheme – email: news@off-grid.net

Northern Powergrid yesterday outlined the plans that could see mains electricity delivered to properties in Upper Coquetdale in the Coquet Valley, Alnwinton.

The firm is looking to install overhead lines that will be intercepted by interconnecting underground cables in the Northumberland National Park, which will secure an electricity supply to off-grid properties and three emergency cell masts.

The plans have been lodged with Northumberland National Park for consultation before being submitted to the Secretary of State of State for Business, Energy and Industrial Strategy for a final decision.

The application has received a few letters of support with one person writing: “I thoroughly support connecting electricity to homes in the Coquet Valley, my family have farmed there for over 60 years and have had to manage on a diesel generator and power minder batteries, which is ridiculous in this day and age ,the cost of running generated electricity is astronomical.

“My family have been campaigning for mains electricity for many years, I hope at last this will be happening, although I will not benefit as I have retired from the business.”

Another wrote: “There are many homes across rural Northumberland that were never connected to the mains electricity grid many decades ago because it was just too expensive.

“I urge you to approve this scheme, our rural community deserves to be on grid after all these years.”

Rothbury councillor Steven Bridgett said residents and organisations have been working for many years to address the issue.…