Such concern led Rep. Brad Galvez, R-West Haven, to successfully sponsor HB317 in the Legislature. The bill, which awaits Gov. Gary Herbert’s signature, would require the state to recognize gold and silver coins issued by the federal government as legal tender.

“This is a step in preparedness,” Galvez said. “It underscores the concern many Utahns have about what is happening to the value of their money. And it will allow us to help protect our economy as the dollar continues to shrink in value.”

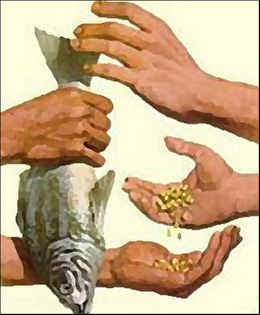

Fifty years ago someone could buy a loaf of bread with a silver dime, argued Larry Hilton, a Highland lawyer who helped draft the Galvez bill. “Today you could still buy a loaf of bread with a single silver dime.”

Even if the nation escapes the consequences of its rising trillion-dollar deficits, Hilton said a system based on gold and silver just makes sense.

He hopes the bill he helped promote marks the beginning of an alternative system of exchange separate from the Federal Reserve and its printing presses.

“Utah can help lead the way,” he said.

Yet not everyone is enamored with the metals.

“For everyone who comes in wanting to buy we have someone coming in wanting to sell their gold and silver,” said Gaylen Rust, owner of Rust Rare Coin in downtown Salt Lake City.

Still, Rust sees an increasing number of retirees and those nearing retirement who are quietly buying silver and gold coins as insurance against what they fear will be a continuing decline in the dollar’s value that will erode the purchasing power of their savings.

“There is this underlying fear of inflation that speaks of a lack of faith in the Fed,” Chris Wright, of Cascade Refining, a company that buys and refines scrap gold and silver, told the Salt Lake Tribune. “That fear also is helping keep the prices up.”

But the staff at Cascade Refining also has noticed that the higher the price, the more people want to sell their gold and silver.

“Every time the price goes up it inspires more people to search through their jewelry boxes for chains and rings they no longer want or need,” Wright said.

The strong price for gold and silver led Bob Pinkerton of Salt Lake City to visit Cascade Refining last week to sell a few rings and necklaces.

“Let’s just say that a couple of years ago when I was out of work the gold and silver jewelry we had on hand came in real handy,” Pinkerton said. “While I’m worried about the possibility of inflation, I’m worried about a lot of other things, too like being able to pay my bills.”

One Response

Interesting, how one group of inanimate objects (metals) can give comfort for some folks, over another group of inanimate objects (money). We can only hope history continues to repeat itself. If TSHF, I will be interested in neither of those. I think I would be more concerned with food and shelter. For many, TSHF 2 years ago with real estate tanking with little chance of recovery in a reasonable amount of time.