Solarworld – not the only one going north

Alternative Energy companies across Europe are considering floating their shares in the coming months as the soaring price of oil makes solar and wind power ever more attractive than costly and polluting fossil fuels.

We see money going to solar and wind. Governments recognise the fact that those technologies have entered the business and see the necessity for further development to make them more efficient and cheaper.

Only last week Spain approved measures to more than double its production of renewable energy with most coming from new wind power projects. Shares in solar and wind power companies have climbed sharply since the start of the year on hopes of an investment boom in response to high oil prices and a European Union drive to curb greenhouse gas emissions.

The share of renewables in the energy supply for IEA countries rose to 5.5 percent in 2001, from 4.6 percent in 1970 with most of the increase from 1970 to 1990.

High power prices will help renewable projects find finance often a problem for many schemes despite government-backed subsidies in many countries. High electricity prices make renewables more viable this helps with returns and financing, said Richard Slark of UK-based energy consultants ILEX.

Powerdown: Options and Actions for a Post-Carbon World – buy from Amazon UK

Powerdown: Options and Actions for a Post-Carbon World – buy from Amazon UK

Powerdown : Options and Actions for a Post-Carbon World – amazon US

In Britain, many wind projects have struggled to find funding after a slump in electricity prices in 2001 following reforms to the power trading market. The UK is facing an uphill battle to meet its target of generating 10 percent of its electricity from natural sources by 2010, up from around three percent currently.

In Europe, interest in renewables has also been reignited recently by a drive by countries to curb their greenhouse gas emissions to meet their commitments under the Kyoto Protocol on climate change.

Tidal power is also in the spotlight but the technology is in its infancy, comparable with wind power in the 1970s.

The British government has given grants to a number of tidal and wave power projects. Rocketing oil prices are also raising demand for biofuels made from crops including sugar cane and corn. Sugar prices are hovering near a seven-year high as cane is increasingly being diverted into producing sugar-based ethanol.

The largest markets for solar power � Germany and Japan � have already been boosted by state support, which has made relatively-costly products such as roof-top solar panels affordable to the people.

And despite the sharp rise in oil prices most solar companies are likely to remain dependent on political support for the medium term, which exposes investors to political risks.

But solar cell maker ErSol Solar Energy AG and sources at wafer maker PV Crystalox Solar AG and component and systems maker Renewable Energy Corp AS (REC) all said they were considering listing in Europe.

“Investors are willing to pay a lot for solar companies at the moment, but we are searching for the best long-term option which may be an IPO,” one of the company sources said.

Solar cell maker Q-Cells AG may also seek an initial public offering, bankers familiar with the talks said but Q-Cells declined to comment.

Elsewhere, Cypress Semiconductor Corp. plans to spin off its solar products unit SunPower Corp. via a listing in New York in the final quarter of 2005.

Solar-power firms can approach new investors with a story of increasingly competitive products as fossil fuel prices climb to record levels and of favourable legislation as states seek to cut their reliance on imported crude oil.

The oil price crises in the 1970s spurred massive investment in renewables, and now with crude hitting $70 a barrel the sector is set for another boom, analysts said.

In Europe interest in renewable energy sources has also been reignited by a drive by countries to curb their greenhouse gas emissions to meet commitments under the Kyoto Protocol on climate change.

“The main drivers of the solar industry are legislation, increased cost competitiveness to other energy sources, off-grid applications, and more expensive fossil energy,” said Martin Hoerstel, an equity capital markets banker at Deutsche Bank.

Solar cells are used predominantly for electricity grid-connected applications but analysts are also becoming excited about the potential growth in more economically-viable consumer product applications such as solar power sunroofs for cars.

As with every investment, analysts say there will be risks involved in solar power investments. “These risks include potential shortages in silicon supply, changes in German pro-solar policies, rising interest rates, lower oil prices and a backlash against solar by generating companies,” said broker CLSA Asia-Pacific Markets in a note.

Germany’s renewable energy law which subsidises solar power is up for review in 2008 and since German Chancellor Gerhard Schroeder announced he would hold early national elections, there have been concerns the favourable policy will change.

The opposition conservatives have said they will do away with “ideological energy policy” and have attacked exorbitant subsidies, but have also said they would safeguard Germany’s leading role in solar and wind power technologies.

“The supply of silicon is a much more imminent problem. There is a fierce fight ongoing for silicon. In a way the solar industry did not anticipate the level of its own success, neither did the silicon producers,” said Deutsche’s Hoerstel.

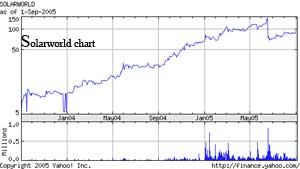

But for those European companies who do go ahead with share offers, they have the already traded SolarWorld and Conergy to measure up against.

“We will see more solar energy IPOs after Conergy’s listing in the first half of the year, which was a success,” said Eberhard Dilger, head of Equity Capital Markets at Commerzbank.

Integrated solar power group SolarWorld AG is trading on a price earnings ratio of 20.2 times 2006 earnings and Europe’s largest solar-specific systems integrator and distributor Conergy is on 16.4 times. This compares with the Europe IT hardware sector on 17.2 times and the global chip sector on 20.8 times, according to Alistair Bishop, an analyst at broker DrKW.

CLSA Asia-Pacific Markets said it saw a market cap for Q-Cells of $1.4 billion to $2.8 billion and expects REC to weigh in at $1 billion to $2 billion.

And the retail investor is expected to vie with large institutions for shares in solar companies, particularly in Germany where the public widely uses solar products.

“It is no longer a niche market for those that are ecologically minded,” said Deutsche’s Hoerstel.

Involvement by German retail investors would also mark another step towards their return to the stock market after their love affair with technology stocks in 2000 and 2001 went spectacularly wrong when the Neuer Markt collapsed.

It will also boost the number of German IPOs this year. The volume of deals so far in 2005 is already at its highest point for four years according to financial data provider Dealogic, but is still only a fifth of the cash companies raised via listings in 2000 at the height of the technology boom.

Michael Rogol, an analyst with CLSA Asia-Pacific Markets who tracks the global solar market, says the stocks in the sector are up about 150% over the past 12 months. Wall Street is ramping up to slake the thirst for solar stocks with more supply: SunPower, a subsidiary of chip-maker Cypress Semiconductor, has filed to come public, as has Q-Cells, a large, fast-growing German solar-cell company that Rogol calls “the Netscape of the solar sector.” Another large player, Norway’s Renewable Energy Corp., or REC, has also said it plans an IPO.

Encouraged by this new enthusiasm for the sector in the public markets, venture capitalists have been funding a steadily increasing number of solar-related start- ups, sinking more than $100 million into new solar companies in the first half of 2005. The recently passed energy bill provides some modest incentives for solar power, and many states have installed solar-friendly tax incentives of their own.

While solar represents a tiny percentage of global power generation, it is growing rapidly. Worldwide, solar power production this year should reach 1.5 gigawatts, double the 2003 level. By 2010, according to CLSA, the total should quadruple to six gigawatts. Industrywide revenue, the firm predicts, will grow from $11 billion this year to $36 billion in 2010.

Now that’s some nice, Google-style growth. But investing in the sector isn’t easy. Many of the biggest producers of solar cells are actually divisions of much larger companies-BP, Sharp, Shell, General Electric-that you’d hardly consider pure plays. And most of the more focused solar companies, with a few exceptions, are still private or trade outside the U.S.

Meanwhile, just as demand seems poised to take off, the solar industry finds itself grappling with a shortage of polysilicon, the raw material used to create both silicon cells and semiconductors. At least for the next few years, the industry’s growth rate will be muffled not by any shortage of demand, but rather by insufficient supply. In all, finding good investments will require ingenuity.

The basic idea of solar power is simple. Energy from the sun strikes a silicon panel, releasing electrons and creating electricity. Those panels are connected together in modules, which can provide power standing alone or hooked into the electrical grid. One of the standard, but magical, pitches made by solar equipment providers is the image of your electricity meter running backwards: When the sun is shining and demand for power is high, you can be selling power back to the grid, while others buy it.

What’s not so simple is the economics of solar power. For starters, while the sun’s energy is abundant, it isn’t available 24/7. (You may be familiar with a fascinating natural phenomenon known as “night,” and another frequent but less predictable factor called “clouds.”) Ergo, solar power is more practical in some places than others. Also, silicon panels are rather inefficient: Most of the potential energy in sunshine is lost. So to create meaningful amounts of electricity from solar panels, you need lots of them.

The good news is that as the industry has grown, the retail cost of solar energy has dropped an average of 6%-7% a year for the past 15 years, says Rhone Resch, director of the Solar Energy Industries Association, a trade group. Within 10 years, Resch says, solar should reach parity with the average retail electricity price.

“This is not your grandpa’s solar,” says Ron Pernick, the principal of Clean Edge, a Portland, Ore.-based research firm. He figures the costs of production have been dropping about 18% for every doubling of output — and output is doubling every two or three years. Still, the industry isn’t at parity yet. Resch says solar power, at 22-23 cents per kilowatt, costs about twice as much as the average retail price of electricity in the U.S.

Keep in mind, too, that installing a solar system requires a large upfront capital investment that may require some creative financing. Putting a solar system on your roof with enough cells to run your house could set you back $25,000-$30,000. You do get to lock in costs, though: Resch likens it to buying a car and paying for 25 or 30 years of gasoline upfront.

One small company, Sun Edison, has set up an intriguing scheme where it places solar systems on the flat roof of a supermarket or big-box retailer, then sells the power back to them. The equipment itself is owned by an investor — in each of the four installations they’ve completed, it’s Goldman Sachs — which benefits from tax incentive programs. Sun Edison’s payoff comes years from now as it gradually buys back the equity and associated income in the equipment.

Fortunately for the solar-power industry, a number of state and national governments have decided that there is a public good in developing alternatives to fossil-fuel based energy production, and have installed lucrative subsidy programs designed to overcome the cost differential.

The most substantial incentives have been offered by Japan and Germany. While neither country is among the world’s sunnier climes, both have become the global leaders in solar power. So it should be no surprise that many of the more successful publicly held solar companies are traded in Frankfurt or Tokyo, not New York.

For domestic solar advocates, that situation is a source of no little frustration. “Our resources are orders of magnitude better,” sighs the trade group’s Resch. “But Germany has created the best incentives in the world.” Germany’s policy, designed to reduce the country’s reliance on fossil fuels, provides a fixed payout of about 54 cents per kilowatt hour for as much power as you can produce.

Rick Feldt, CEO of Evergreen Solar, a Marlboro, Mass., solar-cell company, complains that the incentives in the recently passed federal energy bill provides little help. He notes that the bill offers only two years of tax credits, with no assurances after that — not enough to get manufacturers to commit investment capital in the business.

In the U.S., the industry suffered a blow recently from the demise of California Gov. Arnold Schwarzenegger’s so-called Million Solar Roofs initiative, which would have provided substantial incentives in the nation’s largest state for both residential and commercial buildings. Though the measure passed easily in the state Senate, it fizzled after the governor threatened a veto over amendments to the bill in the state Assembly that would have required solar-installation work to be handled by licensed electricians at the prevailing union wage rate. The governor lately has talked about stepping around the legislature via the adoption of similar incentives through the state’s Public Utility Commission.

While the status of the California measure is important, the talk of the solar industry is the ongoing shortage of polysilicon, the raw stuff used to manufacture photovoltaic cells. For many years, the only real use for that particular material was to make silicon wafers for the semiconductor industry; the solar industry’s needs were minimal. But not anymore.

Thanks in no small measure to the incentive programs in Germany and Japan, solar-cell demand has expanded 40% or more for several years running, versus 20%-25% in the past. The result is that by 2006 almost half of the world’s polysilicon supply will be soaked up by the solar-cell makers. Richard Winegarner, proprietor of consulting firm Sage Concepts, says the market is about 10% short this year, with the solar-cell industry, and not chip makers, absorbing most of the resultant pain.

“I can’t find a data point anywhere that shows anything other than a very real shortage of polysilicon that is going to get worse over the next two or three years,” says Paul Leming, an analyst with Princeton Tech Research. “It would take a solar-panel market collapse to bring any slack capacity to the polysilicon business any- time soon.”

Not surprisingly, polysilicon prices have soared: Winegarner says contract pricing has moved from about $32 a kilogram to $45 since 2003. Spot pricing, depending on whom you ask, is running $60-$80 a kilogram, though Winegarner notes that there is “essentially no volume” in the spot market. “The industry has already wrung out every nook and cranny of inventory and scrap,” he says.

The world’s polysilicon makers are working frantically to add capacity, but supply is unlikely to catch up for a while. Optimists think the shortage could be cured by 2007. Neil Gayle, coordinator of the Critical Materials Council of Sematech, a chip-industry consortium, thinks there could be shortages though 2009.

The bottom line is that there won’t be enough solar cells to meet demand for at least the next several years, potentially triggering a supply crisis for some smaller players that lack contractual supply arrangements with polysilicon producers.

The chip industry has expressed its own concerns about the potential for the shortage to slow the electronics business. But this is a lot bigger problem for solar-cell companies than for the chip industry: While silicon represents less than 1% of the cost of semiconductor products, they account for more than 30% of the raw-material costs for solar cells. A doubling of silicon pricing wouldn’t mean much for chip makers, but it would be a big problem for the solar business, which must hold down costs to compete with conventional power.

The obvious play on the polysilicon shortage is MEMC Electronic Materials (ticker: WFR), a St. Peters, Mo., company that is one of the world’s largest producers of silicon wafers. Unlike some of its rivals, MEMC produces most of its own silicon feedstock, and in fact sells some excess supply back into the market. The result is that MEMC benefits from soaring wafer pricing without suffering the associated increase in raw-material pricing. MEMC shares have doubled over the past year, to a recent $19.79, boosting the company’s market capitalization to about $4 billion. That makes MEMC the largest-cap play on solar growth.

And there may still be some juice left in MEMC shares. Leming of Princeton Tech Research thinks the stock could move up another 50%, and says he can “sketch a scenario where it can double or triple from here,” noting that the company trades for only about 12 times expected 2006 earnings of $1.56 a share. Profits at that level would be up 39% from an expected $1.12 a share this year. And this, by the way, is for a company that does not yet do much direct business with the solar industry. Leming thinks MEMC could eventually cut a deal with solar-panel makers to provide dedicated wafer supplies. If so, Lemming says, the growth could lift the stock to $50.

MEMC ranks fourth in the world in polysilicon capacity, behind Hemlock Semiconductor, which is partially owned by Dow Corning. Third on the list is the other potential wafer investment, Japan-based Tokuyama. Also in the top five are Wacker Chemie, a privately held German chemical conglomerate, and Advanced Silicon Materials, which was recently sold by Japan’s Komatsu Electronic Metals to Renewable Energy Corp., the Norwegian solar-panel maker. The purchase of Advanced Silicon by REC, which as noted is planning an IPO, assures the company of sufficient silicon supplies.

Then there’s SunPower, the Cypress subsidiary now in registration to come public. It is losing gobs of money — for the first half of this year, it lost $13.6 million on revenues of $27.3 million. But the company is attracting considerable interest for its highly efficient solar cells: The company claims in its SEC filings that it generates up to 50% more power per unit of area than conventional cells. In an industry where driving costs lower is a key to long-term success, SunPower should attract eager buyers.

The only current domestic pure-play solar option is Evergreen Solar (ESLR) of Marlboro, Mass. — and it has some similar attractions. Evergreen shares have increased sixfold over the past 18 months. The company uses a novel process for generating solar cells that it claims uses 35% less silicon than conventional manufacturing processes. That should give Evergreen an edge in the race to reduce costs. And CEO Rick Feldt says the company has a pilot project that would cut the silicon used per wafer by another 50%.

While certainly the Street is enamored of Evergreen’s technology, analysts are equally enthused about its joint venture with Germany’s Q-Cells. The two companies are building a new solar-cell manufacturing plant near Q-Cells’ headquarters in Thalheim, in eastern Germany. The plant will dramatically increase Evergreen’s capacity, adding 30 megawatts of cell production to the 15 megawatts it can produce at its own factory in Massachusetts. Feldt thinks the German plant will be far more efficient than the company’s domestic plant, perhaps generating $100 million a year in revenue with gross margins of 30%-35%. Assuming the plant comes on stream as expected, Feldt says, the company should turn profitable on a run-rate basis sometime in 2006.

Moreover, Feldt says that if the German venture is successful, the partners would increase their production to as much as 120 megawatts. And if that happens, he says, the joint venture could add additional capacity in other locations. If that all plays out, says J. Michael Horwitz, an analyst at Pacific Growth Equities, “it could be one of the better stocks in 2006.” And if the German project has problems? Then so will the stock.

CLSA’s Michael Rogol, a big Evergreen fan, in a report earlier this year, listed a total of 15 solar stocks to buy. Many are outside the U.S.: Kyocera, Sharp and Sekisui Chemical of Japan; Thailand-based Solartron; Motech of Taiwan; Carmanah and ATS in Canada; and Germany’s Conergy and SolarWorld.

The global range is a reflection of the fact that, unlike oil or gas or coal, producing energy from the sun is about creative engineering and — at least for the moment — bold government policy, not geographic advantage. No one is going to discover a new source of sunlight, but it’s possible to figure out better ways to use it. Anyone can get in the game. Even America.