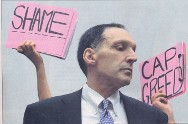

Fuld – no justice if he walks Bernie Madoff ruined the lives of a few thousand greedy rich people and got 150 years in jail. Yet the SEC ignored the frequent complaints about him for over a decade. Meanwhile the disgraced boss of Lehmans, Richard Fuld, who deliberately overstated profits in order to award excessive staff bonuses,has received no penalty for a bankruptcy of over $600 billion – ten times what Madoff stole. Fuld ignored the advice of accountants and auditors. Recently he sold his $13m mansion to his wife for $100.

He received ZERO years in jail.

And John Thain, the former boss of Merril Lynch earned $83m in 2007, after the company’s profits were overdeclared.

He received ZERO years in jail.

In 2008 Merrill was folded into Bank of America, but Thain accelerated $4b of undeserved bonsuses to staff just before the deal closed.

Fuld ‘sold’ his $13.3 million Florida mansion to his wife two months after the investment bank went bust with debts of $613 billion, Florida property records show.

She paid $100 for the transaction, the minimum amount allowed to tranfer property.

The couple bought the five-bedroom home in affluent area Jupiter Island for $13.75 million in March 2004.

The villa is on the exclusive eastern side of the island, facing the Atlantic Ocean.

Miami bankruptcy lawyer Timothy Kingcade said the move may not protect the mansion if there is a civil judgment against Fuld within four years of the deed transfer.

He also noted that under Florida law, jointly owned property is protected from seizure by those seeking to collect a debt.It is just one of the couples’ five homes.

Fuld has been blamed for Lehman’s collapse on September 15th and remains under federal investigation into whether bank executives misled investors about the company’s assets.

He could also face civil lawsuits from investors.

Fuld’s luxury ocean-front home in the exclusive neighborhood of Hobe Sound, Florida

Though Fuld told U.S. lawmakers he took full responsibility for his actions as Lehman’s CEO, he insisted U.S. regulators and Congress shared the blame for the failure.

Fuld, 62, only relinquished the chief executive officer post at Lehman on December 31 2008.

He was paid $34.4 million in 2007.

The banker had stayed on as Lehman disperses assets to pay creditors after America’s fourth-largest investment bank filed the biggest U.S. bankruptcy with $613 billion in debt.

John Thain was the last chairman and chief executive officer of Merrill Lynch before its distressed merger with Bank of America. Thain was designated to become president of global banking, securities, and wealth management at the newly combined company, but he resigned on January 22, 2009. Ken Lewis, CEO of Bank of America, reportedly forced John Thain to resign after losses at Merrill Lynch proved to be far larger than the due diligence team at Bank of America had estimated.

On December 8, 2008, Thain retracted from pursuing a controversial bonus of $10 million from the compensation committee at Merrill Lynch.

On January 22, 2009, it was revealed that, in early 2008, Thain spent $1.22 million in corporate funds to renovate two conference rooms, a reception area, and his office – including $131,000 for area rugs, a $68,000 antique credenza, guest chairs costing $87,000, a $35,000 commode, and a $1,400 wastebasket.

Thain accelerated approximately $4 billion in bonus payments to employees at Merrill just prior to the close of the deal with Bank of America. Bank of America was aware of the decision, as it was reportedly one of the pre-agreed conditions under the merger agreement. Speculation mounted that TARP funds were used for the bonus payments, but the TARP recipients are yet to disclose how TARP funds were segregated, or what they were used for.