United States is leading a decline in energy use amongst advanced economies – with use down 2% last year despite GDP growth. The previous year (2013-2014) EU countries saw a 10% drop in energy use – partly due to economic chaos in Greece, Spain and Italy.

United States is leading a decline in energy use amongst advanced economies – with use down 2% last year despite GDP growth. The previous year (2013-2014) EU countries saw a 10% drop in energy use – partly due to economic chaos in Greece, Spain and Italy.

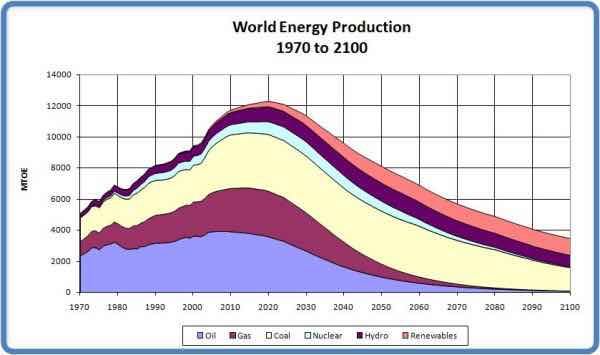

Th uneexpected fall is due to greater efficiency, new materials and the rise of renewables — all the standard projections still predict ever rising demand driven by population growth and the spread of prosperity in emerging economies. That assumption, however, begins to look too simplistic. The reality is more complex. Forget the old debate about peak oil. Now it seems we are approaching peak energy.

The data speak for themselves and are summarised here by Enerdata. It covers the 20 nations which represent more than 80 per cent of global gross “democratic” product.

Economic growth. Energy consumption

2015 + 2.8 % + 0.5 %

2014 + 3.4 % + 1.1 %

2003-13 + 3.7 % + 2.1 %

Within this aggregate data there are a number of different national stories reflecting the influence of different patterns of economic activity and of course the very different resource bases.

In the EU total primary energy demand is down by almost 11 per cent in the past decade. Oil consumption has fallen by 17 per cent; natural gas by almost a fifth.

In China demand growth has slowed in the past three years — as a result of the recession but also because of the changes in industrial structure. Coal remains the dominant fuel but falls in steel and cement production, and in efficiency gains, appear to have decoupled energy demand from GDP. The caution, as ever, is the quality of Chinese statistics.

In the US total energy consumption has been flat for the past decade, with a strong shift in the mix in favour of gas as a result of domestic shale developments.

India is in many ways the outlier. Strong economic growth is fully reflected in increased energy use, and in growing use of coal as the primary source of energy. Coal in India, as the Enerdata commentary puts it, is privileged and low cost. Some 35GW of new coal-fired power plants have been installed in the past two years alone.

Even though coal use fell in almost every other country, Indian consumption was sufficient (along with high levels of use in nations such as Germany) to allow coal to remain the largest single source of primary energy across the G20. The strongest growth in GDP and energy consumption is in areas still heavily reliant on coal in the absence of any readily available low-cost alternative for the production of power and heat. This tempers the impact of the slowdown in energy use on CO2 emissions. The trend is positive — emissions barely increased in 2015 — but not sufficient to meet the targets set at the Paris climate meeting last year.

The stagnation of total energy consumption highlights the fact that demand is not driven by price alone. The standard assumption might have been that sharply reduced prices — for oil, gas and coal — would lead to a rise in demand. The reality is that price signals are often muffled by subsidies (in countries such as India) and by taxation (as in the UK). In most countries factors other than price are clearly more important in determining how much energy we use.

The crucial factor in the shift in the relationship between economic growth and energy use is not price but technology. Those thinking of the future should take note of the fact that the obvious gains in energy efficiency and intensity clearly have further to go. As yet we have barely seen the benefits of smart meters and grids, the application of advanced materials and the continuing gains in areas such as fuel efficiency. There is more to come and an obvious target is the amount of energy that is still wasted.

Stagnation does not mean that we have yet reached peak energy demand. We do not know the details of what is happening in China or the extent to which the emergence of the Chinese from recession will push energy demand back up again. India is now the main driver of energy consumption and unsurprisingly, given the need for basic infrastructure and construction, energy intensity there continues to rise. It is hard to see that trend reversing. Worldwide, population growth continues and in addition there are still well over 1bn people excluded from the world market by poverty. If that number can be reduced, energy demand should grow — but, with OECD demand beginning to fall, the net result could well be that we will see peak global energy demand within the next decade.

2 Responses

Et si l’on change les règles du &#u2&0;je82#8221;, autant de la banque centrale qui devra avoir un autre objectif, que de la régulation, basée sur des principes différents.Jusque là , ce sont les lobbyistes qui ont produit les lois/structures, tout particulièrement dans le domaine financier. Des principes différents produiront des règlementations différentes, et des organisations adaptées à ces règlements…

“The unexpected fall is due to greater efficiency, new materials and the rise of renewable’s…” That’s incorrect. The decline is due to demand destruction. As you can see in this chart (https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=a103600001&f=a), gasoline usage was stable between 1985 and 2006 at about 61 million gallons per day. That “stability” over those two decades conceals the fact that the US population grew over that time 25% from 240 million to 300 million. Further hidden in those numbers is the fact that the ’80’s were an era of economical 4 cylinder vehicles, while the 2000’s were the age of the gas guzzeling SUV.

Starting in 2006 we see a decline in usage that accelerates after 2008, until in 2014 American consumers are using roughly 1/3 of the amount of gasoline they had since the ’80’s. As 2015, US population stood at 320 million, up 33% from 1985, while gasoline sales are down 59% at 25 million gallons per day.