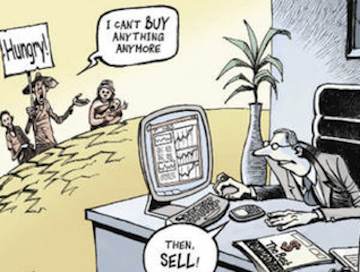

Weird weather, coupled with rampant commodity price speculation, low levels of strategic stockpiling and increases in the price of agricultural staples such as corn, soyabeans and wheat, have created a volatile cocktail. Wheat and corn prices are soaring for the third summer in five years, and the prospect of another price shock is with us once again.

The US drought is the main reason that soybeans are at record prices. And the heatwave currently threatens the US grain harvest. Any further occurence of extreme weather – be it cold or wet or super-hot could tip the global economy into crisis.

The Financial Times reports the US Department of Agriculture this week making the largest downward revision to its estimate for a corn crop in a quarter of a century.

The US is the largest exporter of corn, soyabeans and wheat, accounting for one in every three tonnes of the staple grains traded on the global market.

Prices for this year’s grain crop, deliverable in December, has jumped 45 per cent in a month, drawing comparisons with 2007-08, when a price surge triggered the banking collapse – and a wave of food riots in more than 30 countries from Bangladesh to Haiti,

In 2010, when Russia banned grain exports, it set off a price jump that some have argued helped to cause unrest across the Arab world last year.

Luke Chandler, head of agricultural commodities research at Rabobank, a leading lender to global agribusiness, says: “This certainly has the potential that we go back to a 2008 scenario.”

The one bright spot, for now, is that the situation is less extreme for wheat and rice, the food commodities that are staples for most of the world’s poorest people. In contrast, corn and soyabeans feed animals, produce ethanol or make cooking oil.

While corn prices are trading above their 2008 peaks, and soyabeans this week surpassed the 2008 high to hit a new record, wheat and rice prices are not yet in record territory.

While wheat prices have rallied above $8.40 a bushel – the price touched in the direct aftermath of Russia’s 2010 export ban – they remain well below the 2008 record of $13.345. Rice is trading more than 40 per cent below its 2008 high.

Nonetheless, the dramatic rise in grain prices in recent weeks is likely to feed through into the price of food. Karen Ward, senior economist at HSBC, says: “What the world economy really needs right now is a break. Any inflationary pressure, particularly that stops the emerging world loosening policy and providing the boost to the global economy, would be a problem.”

Jeffrey Currie, head of commodities research at Goldman Sachs, points to the close link between Chinese food inflation and the price of soyabeans, of which the country is by far the largest importer.

Moreover, the low level of global inventories for grains means that any further disruption to supplies could be devastating.

Global corn stocks are forecast by the USDA to fall to just 15 per cent of annual demand, close to a record low.

Hussein Allidina, head of commodities research at Morgan Stanley in New York, says: “I don’t think the alarm bells need to

be sounded yet. But unlike previous years, we don’t have the inventory cushion for insurance against any further yield downgrades.”

With the prospect of a return of El Niño, the weather phenomenon that triggered droughts in Argentina and Australia, contributing to the 2007-08 crisis, later this year, the world economy will be once again beholden to the weather.

Mr Abbassian of the FAO says: “We’re back to square one of last year – you’re basically back to a hand-to-mouth situation. We have a very bumpy road ahead for the next few months.”

2 Responses

I am a farmer in S. Ga. I grow corn, wheat, soybeans, cotton and peanuts. The US has ample supply of grain. We export nearly half of our production and with other developing countries like parts of Africa and South America coming on line using the latest GM crops we can easily meet the food needs of a growing world. In 1967 we were selling corn for 3.75, wheat 4.50, and cotton at .60 per pound. Its over 40 years later and we are with in 50 % of those prices while production cost has gone up 12 times the 1965 rate. Its only through mass production of safe abundant food that the American farmer has survived. Fear is being used to make money off the uneducated, this is nothing new.

Always about the money but what about – – –

https://www.oakcreekforum.blogspot.com/2012/07/is-this-year.html