Shortage of cables means grid delays and rising costs

Every major economy is fighting for supplies needed to expand their electricity grids. Over 80 MILLION kilometers of cable will have to be replaced by 2040 under current decarbonisation plans, says the International Energy Authority.

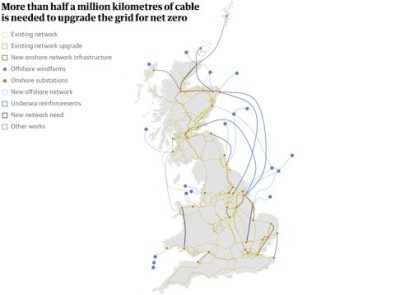

In the UK alone that is 100 km of heavy-duty overhead cable per DAY from now until 2040. the rate of cable laying is unprecedented – approximately 16 TIMES the rate over the past 30 years. The manpower and the resources do not currently exist.

Demand is pushing up prices, and queues for energy are growing longer. New housing developments in West London are being quoted 10 YEARS, before they can get a grid connection, and the same is happening everywhere.

Britain’s first electricity networks commissioner, Nick Winser, warned in a landmark report earlier this year that the UK would need to connect about four times as much new transmission capacity to the network in the next seven years as has been built since 1990.

To meet this challenge, Britain will need to halve the time it takes to build and install pylons and cables for a new transmission project from 12-14 years to just seven.

He also said existing energy policies were “badly out of date”, and the UK needed a new strategy to shore up its manufacturing supply chain, which would involve training skilled workers.

High-voltage cables and equipment looked set to be in short supply for years or even decades, said Winser, because already producers were struggling to meet demand. As happened with vaccines during the pandemic, companies and even governments will find themselves competing to snap up available stocks.

And skills gaps threatened to “haunt” the UK’s green agenda, he added, unless there was heavy investment to create a new reservoir of trained staff.

Already energy companies have been “scrambling” to secure manufacturing slots, according to Alistair Phillips-Davies, chief executive of SSE. He told the Observer that his company, which has this year committed to investing more than £40bn in green energy and grid upgrades over the coming decade, had secured “around 80%” of the materials it would need for its grid upgrades.

British-owned cable manufacturer XLCC is planning to build the UK’s first factory making high-voltage undersea cables in Ayrshire to help meet demand. Production could begin as early as 2026.

Ian Douglas, XLCC’s chief executive, believes demand for high-voltage cables will increase sixfold over the next seven years, as global use of renewable energy expands. Its first order is from its parent XLinks, for four 3,800km cables to connect solar and windfarms in the Moroccan Sahara to the UK.

“The whole impetus and momentum of net zero risks being hamstrung by a lack of cable,” said Douglas. “The requirement to upgrade the grids is global, and it’s treble what we’re investing globally today.”

The government has accepted the recommendations of Winser’s report, and has already announced steps to …

Embarking on an off-grid journey? Buckle up, because the location you choose might just be the pivot between thriving and barely surviving in your sustainable haven. Finding the right spot isn’t just a choice; it’s a masterstroke in the canvas of off-grid living.

Embarking on an off-grid journey? Buckle up, because the location you choose might just be the pivot between thriving and barely surviving in your sustainable haven. Finding the right spot isn’t just a choice; it’s a masterstroke in the canvas of off-grid living.