Battery costs plummet

Huge advances aimed at the Electric vehicle market are slashing battery costs, changing the way the power grid works and bringing benefits to off-grid communities and industries.

As the world prepares to spend trillions on new renewable energy installations, the cost of storing power is plummeting. Battery costs are the biggest single obstacle to the potential for living and working off the grid, because reliable power storage has been the missing element until now.

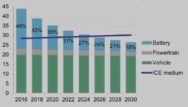

In its latest annual report released this week, Bloomberg New Energy Finance (BNEF) forecasts trillions of investment in renewable energy worldwide in the next 10 years. The need to store renewable energy (along with the coming boom in Elelctric Vehicles (EVs) has led to advances in battery technology and a 75% fall in the cost of batteries since 2010.

As we first reported over two years ago, plans to mass-produce car batteries are behind much of the progress.

Technology is also allowing us to be more intelligent in the way we consume electricity. One interesting idea in the electricity market now is “demand response”. Instead of building capacity to provide extra megawatts, we instead use “negawatts”— forgone power consumption. This already works well with cooling, heating and pumping, which are mostly not time-sensitive. If you run greenhouses, or cold-storage equipment, your only priority is keeping the contents within the right temperature range. Whether the machinery comes on at five minutes to the hour, or ten minutes past, does not particularly matter.

But to the electricity networks, this flexibility matters a lot. When demand spikes — say on winter mornings — they no longer need to use the dirtiest and most expensive generating capacity, such as banks of diesel generators, to keep the lights on. Instead they pay companies to postpone power consumption to a more convenient time. The result is greater efficiency and lower costs.

Increased use of electric vehicles will create even more flexibility: they can charge overnight on cheap wind power, and even send electricity back into the network when needed.

This is not good news for the utility companies. They like big, expensive investments because, in a regulated market, they can dump the cost — plus a profit margin — on the consumer. The question that no country has answered is how to manage the transition between the expensive, old-style power system and the decentralised, flexible, low-cost (and low-carbon) future.

BNEF’s annual energy outlook, published this week, forecasts $7.4 trillion (£5.8 trillion) of new investment in renewable energy by 2040. That is an encouraging leap on previous predictions — but still short of the nearly $13 trillion investment in zero-carbon power it reckons is necessary.

Even without the fall in battery costs, coal is ailing even in countries without abundant natural gas. China and India are turning away from the black stuff, partly to stem public fury at air pollution, but also …