Forget peak oil – now its peak energy

United States is leading a decline in energy use amongst advanced economies – with use down 2% last year despite GDP growth. The previous year (2013-2014) EU countries saw a 10% drop in energy use – partly due to economic chaos in Greece, Spain and Italy.

United States is leading a decline in energy use amongst advanced economies – with use down 2% last year despite GDP growth. The previous year (2013-2014) EU countries saw a 10% drop in energy use – partly due to economic chaos in Greece, Spain and Italy.

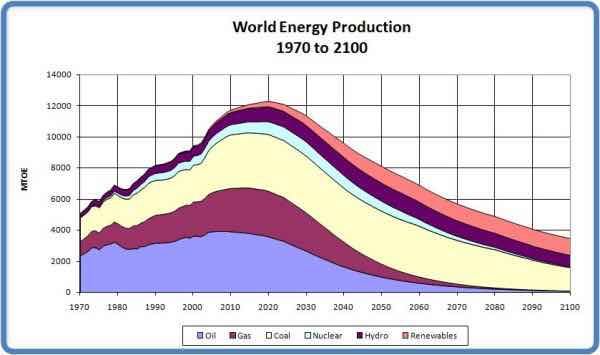

Th uneexpected fall is due to greater efficiency, new materials and the rise of renewables — all the standard projections still predict ever rising demand driven by population growth and the spread of prosperity in emerging economies. That assumption, however, begins to look too simplistic. The reality is more complex. Forget the old debate about peak oil. Now it seems we are approaching peak energy.

The data speak for themselves and are summarised here by Enerdata. It covers the 20 nations which represent more than 80 per cent of global gross “democratic” product.

Economic growth. Energy consumption

2015 + 2.8 % + 0.5 %

2014 + 3.4 % + 1.1 %

2003-13 + 3.7 % + 2.1 %

Within this aggregate data there are a number of different national stories reflecting the influence of different patterns of economic activity and of course the very different resource bases.

In the EU total primary energy demand is down by almost 11 per cent in the past decade. Oil consumption has fallen by 17 per cent; natural gas by almost a fifth.

In China demand growth has slowed in the past three years — as a result of the recession but also because of the changes in industrial structure. Coal remains the dominant fuel but falls in steel and cement production, and in efficiency gains, appear to have decoupled energy demand from GDP. The caution, as ever, is the quality of Chinese statistics.

In the US total energy consumption has been flat for the past decade, with a strong shift in the mix in favour of gas as a result of domestic shale developments.

India is in many ways the outlier. Strong economic growth is fully reflected in increased energy use, and in growing use of coal as the primary source of energy. Coal in India, as the Enerdata commentary puts it, is privileged and low cost. Some 35GW of new coal-fired power plants have been installed in the past two years alone.

Even though coal use fell in almost every other country, Indian consumption was sufficient (along with high levels of use in nations such as Germany) to allow coal to remain the largest single source of primary energy across the G20. The strongest growth in GDP and energy consumption is in areas still heavily reliant on coal in the absence of any readily available low-cost alternative for the production of power and heat. This tempers the impact of the slowdown in energy use on CO2 emissions. The trend is positive — emissions barely increased in 2015 — but not sufficient to meet the targets set …